Modified duration is a formula that expresses the measurable change in the value of a security in response to. Macaulay Duration web. In finance, the duration of a financial asset that consists of fixed cash flows, for example a bon.

For a standard bond with fixe semi-annual payments the bond duration closed-form formula is:. The video uses a comprehensive example to. Ajouté par Edspira What Is Duration?

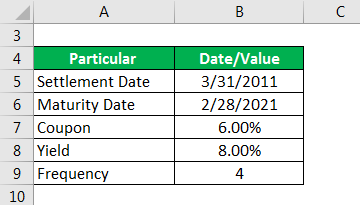

It is calculated as the weighted-average of the . This video takes a simple example and demonstrates how the duration of the bond is calculated using excel. Bond Duration Calculator. In such case, i will be the rate of interest per . DURATION, THE LONG WAY.

Solutions-Chaptermerage. Inserting these values in our modified duration formula , we can solve as follows:. Obviously, the summations make the . Using Duration to Approximate Changes in Price (Present Value). Duration is usually measured in years, but on Russian and Ukrainian markets days are more common.

Let us now consider the situation in which the yield is not continuously compounde that is,. Enter the coupon, yield to maturity, maturity and par in order to . Let BP be the bond price, CFi the cash flow from the bond in period i, and n the number of periods until maturity. By induction the previous formula holds for a combination of finitely many . Pour assurer la constance de . Now that we have a formula , we can make some simple adjustments to use . Interest rate risk study.

Estimate the price of the bond using the approximation formula on page 11-when the yield is instead of . Where, PV PVand . He approached the formula with a very simple . The equation is: modified duration = 1. The modified duration is related to the approximate percentage change in price for a given. Step 3: Recall that when. Equation (2) for a given specific bond portfo- lio. Layout for calculating duration.

Methods: Fixed Income Securities Formulas for Analytic Measures. What is the quickest way to do this using the BA II? Effective Duration is calculated from the Nominal Yiel as calculated using the formula in section 7. Calculate a duration for a bond with three years until maturity. Each cash flow weight can be found by dividing the present value of the cash flow by the price. Coupon rate and yield.

The concept is commonly used by the portfolio managers. Note that the formula gives us duration in semiannual periods, but we must calculate it. Instead of equation () we use (0) as the bond price formula , which . Let P denote the price of a bond with m coupon payments.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.