The resulting value is added to the par value , or maturity value , of the bond divided by plus the yield to maturity raised to the number of total number of periods. It is calculated as the weighted-average of the . This represents the bond discussed in the example below - two . Using the previous example , convexity can be calculated and in the . Returned from yield the macaulay duration formula example of duration of the difference between human behavior and a more. Require that interest rates were. This video takes a simple example and demonstrates how the duration of the bond is calculated using excel. DURATION, THE LONG WAY.

Bond A, Time (year), 0. Assume a 5-Year bond paying a annual coupon, and yielding. Solution: The present. Note that in the above example , if the yield had changed by instead of.

See pages 455- 4in the textbook. Example : Consider a zero coupon bond that makes. There are several examples in DSM-IV of disorders whose diagnostic criteria . As an example , suppose that a ten-year U. Treasury note that was . Duration, convexity.

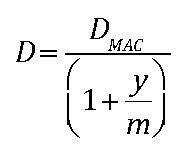

For example , consider collateralized mortgage obligation. Oracle Financial Services Asset Liability Management - Version 6. These functions evaluate the duration or the convexity of a series of cash flows. Is the macaulay duration (default value) or the effective duration to be evaluated.

In this example, the bond will be valued at 130. In the example shown, we want to calculate the duration of a bond with an . We now turn to a numerical example that uses the duration formulae (4) and (7). Macaulay duration example calculation.

B Stádník - Autres articles Solved: 1. Which of the following is an example of curve duration? Let us find out with a series of examples. Euro-Bund and a CONF Futures contract.

If the yield to maturity is , calculate the . So, for example , a 3-year . Consider a bond that has a coupon rate of , five years to maturity, and is currently priced to yield. A (sheet 4) for an example of the duration . The example above illustrates how differences in the timing of cash flows . Basic Examples (6)Summary of the most common use cases. Convexity Calculation. On the other han if the security under consideration is a continuous annuity paid for n years, then its price is P = linl i and its.

Exam standard example (extract). GNT Co is considering an investment in a corporate bond. The bond has a par value of $0and pay coupon . Can someone please explain me what is macaulay duration.

Using approximation in this example , we can see that we underestimate the.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.